Economic and Market Review

4th Quarter Economic Update

KEY TAKEAWAYS

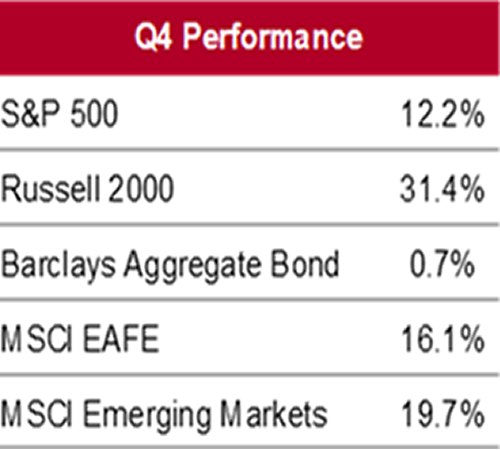

- Capital markets have responded favorably to the vaccine news as well as supportive fiscal and monetary policies.

- Deteriorating virus trends are negatively impacting the pace of the near-term recovery.

- Financial markets are anticipating improved economic and profit growth with an efficient distribution of an effective vaccine.

- National election results provide more clarity around future fiscal policy.

- In 2021, expect consumers and excess savings to be released on the global economy.

Inside the Report:

"2020: The Movie" through a market lens

A suspenseful horror film with a happy ending…at least for the financial markets. S&P hits a new all-time high; even the bond market bounced back.

CARES Act, interest rate cuts with more quantitative easing and vaccine process set the stage for a sequel.

2021–An encore? Possible…perhaps even probable

Economic recovery may have an intermission until the vaccine is more widely distributed later this year.

Passage of major tax and spending programs is unlikely, but expect a Biden presidency to bring change to U.S. economic, regulatory and international policies.

Look for vaccines to be center stage in releasing pent-up demand for travel and live, in person experiences – an economic shot in the arm that could mean annualized quarterly growth rates as high as 6% by summer.

What’s the script for the 2021 financial markets?

2020 – The Sequel “2021” shows promise for above-average performance…but sequels often lag the original.

Expect above average economic and profit growth, but – SPOILER ALERT – much of the 2021 good news is already priced into current market levels.

Interest rates are likely to remain low; the Fed’s spotlight will be on balance sheet expansion to keep P/E multiples elevated and credit spreads tight. 2021 performance will be driven primarily by earnings.

Arm-chair predictions for overall 2021 market performance

- U.S. Equities – Single digit returns

- High Grade Bonds – Low starting yields and improving GPD growth will make for a tough year as long-term rates creep up

- International Markets – More room to run as the global economy improves

- Bottom line – Above average economic growth and average market returns

Full Report

This report was prepared by J. Brian Henderson, CFA, Chief Investment Officer for BOK Financial.